Kelly K. James is a longtime freelancer who covers health, fitness and wellness topics from Downers Grove, where she lives with her family.

Why you need a health insurance agent and how to find one

When I lost my job in a company-wide layoff, I faced a multitude of concerns: How would I find a new job? How long would my savings last? And what would I do about health insurance?

While the Affordable Care Act (ACA) has provided health insurance to millions of Americans, it hasn’t cleared up the confusion. How can you know if you need Medicare, Medicare Advantage, or a supplemental plan? What about COBRA? Or a silver, gold, platinum, or some other precious-metal plan?

Whether you’ve been laid off, gotten divorced, or are preparing to enroll in Medicare, you need affordable, good quality health insurance.

Who needs an insurance agent?

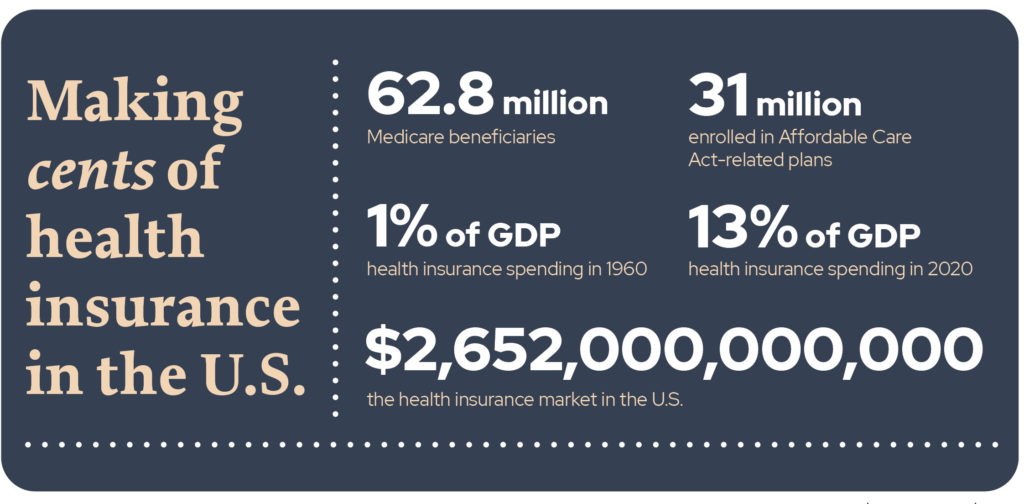

Health insurance numbers are staggering: There are more than 333 million Americans, all of whom need health insurance. The size of the health insurance market in the U.S. alone rose to more than $2.652 trillion in 2020 — more than half of the $4.1 trillion National Health Expenditure. It’s a nearly unfathomable number.

“Every time you need help navigating the insurance landscape, you should look for an advisor or broker,” says Carrie Espinosa, principal advisor and owner of Horizon Benefit Services, an insurance agency in Gurnee.

Robin Dawson is an independent health insurance broker in Chicago who deals primarily with Medicare. She says most people can benefit from working with an expert. “When people are on group insurance, everything is pre-negotiated on their behalf by their employer. When they get to a juncture where they need to be individually insured, they have to make all of these decisions that previously were made for them,” Dawson says.

Health insurance agents can guide people through decisions customized to their needs and budget. Dawson says this is “critically important” because Medicare insurance products are not one-size-fits all. “It’s such a competitive space, and there are so many products to choose from, it can get very overwhelming.”

In place of an agent, some people look online for information and policies. Dawson points to numerous government resources about Medicare plans.

“Online tools can provide a lot of information for the general population, but your health and prescription needs, budget, lifestyle, and transition from current coverage all need to be considered when picking a suitable plan,” Dawson says.

Not using an agent may cost more in the long run if you don’t secure the right plan. An oversight, like not confirming whether your doctor or current pharmacy is in your plan, can cost a lot of money over time.

How to find an insurance agent or broker

You’ve probably seen commercials advertising a 1-800 number for help with Medicare. “Those numbers are popular, but you’re getting a call center staffed by people who then sell your information,” Espinosa says. “In our industry, there are captive agents, who work for insurance companies, and independent brokers who work for the consumer. [Look] for a broker or independent advisor who will work with you and understand your needs.” Usually there’s no charge for working with an independent agent, as they receive commissions from insurance companies.

Dawson adds that captive agents only represent a single company’s products. “Brokers or independent agents represent multiple companies and products, so they can give consumers more options to choose from when they are shopping around.”

Start with these resources:

Get recommendations from professional advisors, such as your lawyer or accountant, as well as friends and coworkers, particularly if you need assistance with Medicare.

Check out Google Business listings, and read customer reviews.

Consider agents who educate the public through seminars or programs, but check out their customer reviews before hiring.

Visit the National Association of Health Underwriters (NAHU) directory of health insurance agents.

Once you’ve narrowed down your list, ask each candidate how long they’ve been in the business, what their specialty is, and which insurance companies they represent, Espinosa says.

Your broker is there to help you select an insurance company, help you with the paperwork, answer your questions, and advocate for you with the company you choose. “A good agent will listen to your needs, lead with education, and let you make a fully formed decision for yourself,” Dawson says.

As for me? While I look for a new job, I’m using COBRA coverage — the federal law that lets former workers stay on their employer-provided health insurance temporarily. Hopefully I’ll find work that offers me and my kids good health insurance. But if not, I’ll work with an agent, now that I know how they can benefit me.