Karen Purze is an author based in Chicago, IL. She writes about end-of-life planning and family caregiving at lifeinmotionguide.com.

Solo agers must make plans for support

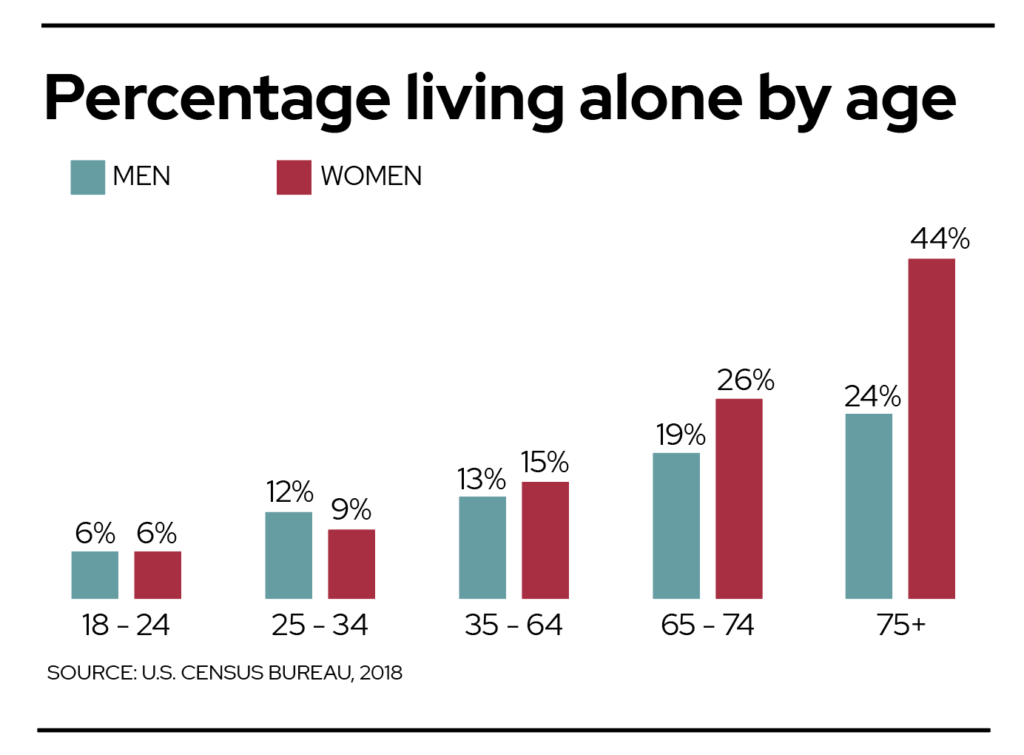

Older adults are living longer and — more often — living alone in older age, creating a care-planning conundrum. About 26% of women and 19% of men between age 65 and 74 live alone, with those numbers significantly increasing for people over 75, according to 2018 census data.

These solo agers — people without a spouse, partner, or adult children in the picture — need a plan in the likely case they need some assistance as they age. Nearly 70% of adults who survive to age 65 develop considerable support and long-term care needs before they die, according to a 2019 study commissioned by the U.S. Department of Health and Human Services.

Local expert Niki Fox is the director of health, wellness, and member services at The Village Chicago, a social network for people over 50. “One of the best ways to find help and support as we age is to explore what resources are available locally before you need help,” she says. “Searching for these resources and connections in crisis never works well for anyone.”

Identify support

Every adult, but especially older adults who don’t have family assistance, should know where they can turn to get support with finances, legal matters, household tasks, and personal care if needed.

“We need to approach [care planning] as a practical, financial choice,” says Jacqueline Boyd, a Chicago-based aging specialist and LGBTQ advocate. “We spend time researching colleges and homes. Why not research long-term care options and create a top three list?” Her business, The Care Plan, provides care coordination and navigation services to LGBTQ individuals, who are twice as likely to be single and four times less likely to have children as non-LGBTQ adults.

Mary Prendergast, a real estate managing broker in Chicago, has given the matter some thought. For many years, she has been taking care of others, preferring to “be the person in charge rather than the person being cared for.”

Prendergast, who lives alone and turns 80 in December,

has family in Arizona but is not interested in moving. Recently, she watched as a friend had to make care decisions

in a crisis. Having seen what happens when someone does not have a plan, Prendergast has taken several steps to ensure her independence as she ages.

For example, Prendergast legally assigned power of attorney delegates (and backups) to assist her with medical, financial, and legal matters, should it be necessary. “I like to be in control of my life,” she says. Importantly, she has shared her wishes with these delegates, discussing her preferences for how, where, and with whom she would want to live if she could no longer live on her own.

In the event of a medical crisis, she says, “Everyone knows. I’ve been very clear about what kind of care I want. I don’t want to be hooked up to machines, [and] I don’t want to live forever. I realize how lucky I am. I’ve had a very full life.”

Preparing the path

Making those plans is especially important for solo agers. “We all need to plan for a longer life,” says Joy Loverde, Chicago author of Who Will Take Care of Me When I’m Old? and an eldercare expert. “It’s no longer a stretch to live past 90. We need to prepare ourselves financially but also psychologically.”

Boyd notes that this can be hard when so many older adults have not spent any time envisioning life as they age.

“Alone or not, when we don’t look at advanced aging, we leave choice on the table. If I haven’t had conversations and let people know what I want, others will make the decisions for me,” she says.

In the absence of legally designated agents, the state’s legal system will determine the path forward — and that may not be the path the individual desires. So, it’s important for solo agers to plan proactively.

“We need to go beyond fear and imagine our futures,” Boyd says. “If we’re thinking and dreaming about it, we’re going to have a better aging experience.”

Solo agers should pay special attention to their social support needs in addition to the more practical matters. Fox says it’s important to “be thoughtful and creative in building your network of support. Get to know neighbors, building staff, or the landlord. Think beyond your family and friends to people who you encounter regularly.”

“Give them permission to help. Give them assignments!” says Boyd, who recommends holding semi-annual gatherings with your support team.

Without a network of support, solo agers may need to hire professionals. For personal needs and healthcare, a care coordinator or professional advocate can help. For finances, a daily money manager or even a financial guardian could become necessary.

“It’s not a given that care will be needed,” says Loverde, whose mother died in her sleep at 92 without health issues. But because we can’t guarantee an end like that, she advises solo agers to take charge. “Nobody cares more about what happens to you than you do,” she says.