Stephanie Bouchard is a freelance journalist who writes about health and wellness, lifestyles, and pets.

Alternative housing ideas can save money and stave off loneliness

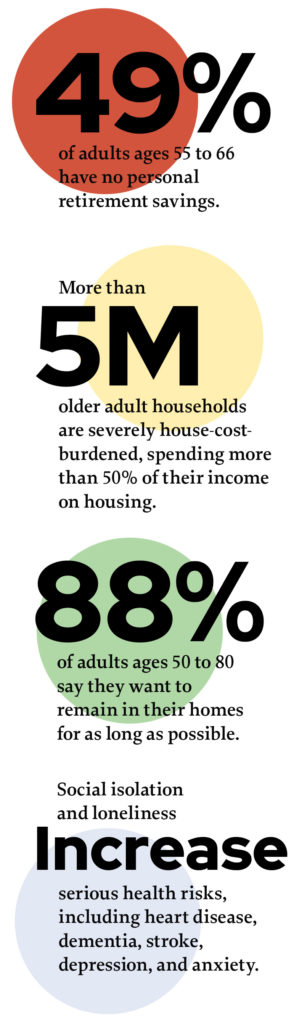

The U.S. is facing a housing crisis. For older adults specifically, the crisis includes factors beyond their control — lack of affordable housing and increased cost of living — as well as personal concerns — having little or no retirement savings, experiencing loneliness and isolation, and feeling anxious about their health.

For all these reasons, older adults need to give serious thought to how, where, and with whom they will spend the latter years of their lives.

Fortunately, people today have many unique options.

“There are so many short-term and long-term trends that are shaping or reshaping that later stage of life,” says Riley Gibson, president of Silvernest, an online home-sharing platform that matches older homeowners with compatible renters. “I think generally what we’ve seen is, people are just needing and are looking for more options, more creative options,” Gibson says.

Types of alternative housing

For some older adults, the desire for social interaction — more than finances — drives them to seek out shared housing.

Loneliness has increasingly been in the spotlight as the baby boomer generation ages. Numerous studies have shown associations between isolation and poorer physical and mental health, particularly among older adults, who are more likely to find themselves far from family and with fewer friends as they age.

Here are a few unique housing options older adults might consider:

Home-sharing: Facilitated by platforms such as Silvernest and Nesterly, these companies help older homeowners to remain in their homes by pairing them with people seeking rental space. Some renters only rent a room while others work out an arrangement for reduced rent by helping with chores around the house.

Multifamily co-living: People of mixed generations have their own bedrooms but share a bathroom, kitchen, and living areas. They also contribute to the cooking, cleaning, and even taking care of each other’s children or grandchildren.

Cooperative communities (co-ops): Similar to co-living, people of all ages live in apartment-style complexes or a neighborhood of individual homes. Individuals live in their own small, private spaces but share communal spaces, such as kitchens and dining rooms, as well as outdoor areas for gardening and socializing.

University-based retirement community: A more recent addition to the intergenerational housing scene, these communities tend to be upscale apartments for older adults, sometimes paired with in-house medical care, located on a university’s campus. Some offer programs that encourage interaction between younger students on campus and older residents, as well as educational opportunities. Older adults living in these university-based communities — such as The Forest at Duke University and Lasell Village of Lasell University — don’t have to be affiliated with the university. For example, they don’t have to be alumni or faculty.

Benefits for all ages

The benefits of multiple generations living together are financial and emotional, according to Pew Research. Younger and older people living together can share the burden of the cost of living, shoulder the responsibilities of caregiving, and provide emotional support, among other benefits.

While many intergenerational housing programs target older adults, the benefits really accrue to everyone, says Gail

Schechter, executive director of Housing Opportunities and Maintenance for the Elderly (H.O.M.E.). The Chicago-based nonprofit has offered intergenerational housing for 40 years in neighborhoods throughout the city.

Intergenerational housing — no matter what form it takes — boils down to intentionality, Schechter says. “It’s not just about people of different ages. It’s about affirmatively creating a welcoming community and everything that entails.”

Intergenerational housing — no matter what form it takes — boils down to intentionality, Schechter says. “It’s not just about people of different ages. It’s about affirmatively creating a welcoming community and everything that entails.”

H.O.M.E.’s Nathalie Salmon House in Rogers Park blends older adults, families with children, and resident assistants living in 54 units. A financially struggling younger person who serves as a resident assistant may pay $500 or less in rent each month in exchange for working part-time hours in the residence. Their work might include tasks such as cleaning up after meals or cooking over the weekend when the staff chef isn’t on duty.

But it’s not all work. “We make sure that there are opportunities for everybody in the building to socialize,” Schechter says. She adds that the older residents love the interaction, but so do the younger residents, many of whom are “getting a start in life.”

Many older people want to live with people outside of their own age range, which spurs them to seek something other than communities limited to ages 50- or 65-plus, says Donna Butts, executive director of Generations United, a Washington, D.C.-based nonprofit working on programs and policies to strengthen intergenerational connections.

“People realize that they felt more isolated [in housing only for older adults],” Butts says. “One of the reasons that people don’t like it is because conversation turns to the three Ps: pain, pills, and passing. That’s all you can talk about with other people who are older — what hurts, what medication you’re on, and who died. When you’re interacting with a 20-year-old or 6-year-old, or other ages, the topics are broader.”

As more people seek out alternatives to age-restricted housing, Butts thinks more intergenerational housing options and development will blossom. “It’s the way of the future,” she says.

Schechter has her eye on future intergenerational housing, too. Looking ahead, she says the next frontier of intergenerational housing will be a continuum of care model, where older residents with chronic conditions such as dementia can remain in their homes and communities, through end-of-life. “That’s a challenge or an opportunity — something that needs to be looked at is how can we take this intergenerational idea and apply it to other kinds of nursing homes or assisted living?”

Aging in place

For those who want to age in their own home, sites such as Silvernest, Nesterly, and Senior Homeshares offer a lifeline — a chance at companionship and a way to generate income. Gibson describes Silvernest as “Airbnb meets Match.com”, without the romantic aspect of Match. The site says it has 50,000 users nationwide.

Older homeowners who want to share their homes with renters can post their homes on Silvernest for free or for a $24.95 a month premium subscription option. The premium option includes tools such as background checks and home sharing agreements. The platform also offers questions to help facilitate a good fit between homeowners and renters.

“Earlier in life, having a roommate is almost expected. Pretty much everyone does it,” Gibson says. “Later in life, having a roommate is much less normalized. It feels less comfortable, but I think that is starting to change.”

And the income a renter brings in can make a major difference. Millions of people on fixed incomes or with inadequate retirement savings are struggling financially to stay in their homes and to pay for the increasing costs of everyday living such as gas, groceries, and healthcare.

“If you can earn $10,000 to $12,000 a year in passive income, that can be big,” Gibson says. “[It] can be the difference between staying in your home or not.”

For those not yet ready to make a major change in their housing situation but who need more help and companionship, the Village movement might be ideal. The Village movement, which began 20 years ago in Boston’s Beacon Hill neighborhood, is a neighborhood-based membership organization built around the notion of neighbors helping neighbors. Nationwide, there are about 250 neighborhood organizations with five in the Chicago area.

In this model, older adults remain in their own homes and pay an annual membership fee of a few hundred dollars to support a small staff. The staff checks in with members and coordinates everything — from organizing social activities to getting groceries to finding contractors for home repairs.

With so many unique housing options, doing your due diligence will help you find the right fit. Read up on the options that are of most interest to you; seek out personal recommendations; and take the time to closely examine your financial, social, and emotional preferences and needs.

Originally published in the Winter/Spring 2023 print issue.