Julie Jacob is a communications professional and writer who focuses on healthcare and technology issues.

If your senior years aren’t quite what you expected, focus on finding your own path

Based on television advertisements targeted at older adults, everyone over 60 is leading a charmed life: feeling healthy, traveling, and spending quality time with grandchildren.

“Retirement is portrayed as a dream and fantasy, where you are 80 and able-bodied. You don’t need any assistance and can meet all of your retirement dreams and travel everywhere,” says Sarah Jackson, a social worker with North Shore Senior Center in Northfield.

However, Jackson adds, “I don’t think that’s the norm. More and more people are struggling. The media sets us up to have these expectations, which are not realistic.”

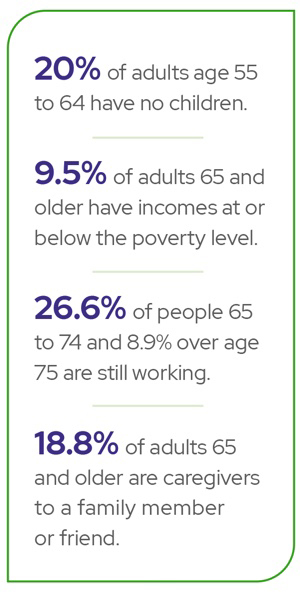

There’s a gap between what the media portrays as normal — affluence, grandkids, and leisure — and how people are actually living. Statistics illustrate this gap between fantasy and reality.

Maybe your senior years don’t match up to what you thought life would be — or to the fun-filled life that your peers appear to be living. Here, Jackson and Judith Jordan, program coordinator for the Weiss Initiative Supporting Our Elders at Weiss Memorial Hospital in Uptown, offer tips on how to cope with common and emotionally fraught situations.

You don’t have grandchildren.

Your friends are constantly showing pictures of their grandkids and saying how much they love being a grandparent.

If you’re the only one in your social circle not passing around photos of your grandkids and you feel left out, Jackson suggests exploring new interests. Instead of dwelling on what you don’t have, expand your horizons beyond your comfort zone.

“Join a class, a club, or some kind of group,” she says. “Go to a senior center, and look for something that interests you.”

Jordan also suggests living the life of a grandparent vicariously by joining in with birthday celebrations and events for others’ grandchildren when possible.

“My friends have grandkids, and I live through their eyes,” Jordan says.

You can’t afford to retire yet…

and are still working when most of your friends are retired.

If you want to retire, being unable to afford retirement stings, especially if your peers tell you about their leisurely lunches and afternoon pickleball games. If you’re in that position, Jackson recommends being compassionate toward yourself, instead of judging yourself for not saving more.

Then, she says, work toward accepting that you may be working longer than expected.

Finally, she says, remind yourself that everyone has unmet expectations. The friends who are enjoying their leisure also have disappointments and challenges.

And Jordan suggests doing what you can to make life enjoyable within your budget. For example, if you can’t afford a dinner with friends, try meeting for lunch. If you can’t afford a bouquet of flowers, pick a few flowers from your garden.

You’re thrust into a caregiving role earlier than expected.

Caring for a loved one with dementia or health problems can dash your retirement dreams.

“People who expected to be traveling or enjoying life in retirement find that there is no retirement, and the dream they had with a spouse can no longer be,” Jackson says.

The key to coping: focus on what you can do, says Jeannine Carey of Niles. Carey’s husband developed dementia in his 50s. At 55, Carey finds herself in a caregiving role.

She and her husband, who is still able to travel and enjoy concerts, focus on checking items off their bucket list now, she says.

Carey doesn’t dwell on comparing herself to other people.

“I can’t really focus on what other people have,” Carey says. “When you see things on TikTok it looks like everyone is having a really fun time, but you don’t know what happened before that picture was taken or after. Everything looks good, but that is not always the case.”

Taking time to care for herself, feeling gratitude for what she has, and staying grounded in the present also helps, she says.

Jordan, who is a caregiver for her mother, recommends seeking therapy to deal with the stress. It’s also key to take care of your own physical and emotional health, she says.

“You have to make sure you have time for yourself, that you are exercising. We have to keep ourselves physically and mentally alert,” Jordan says.

You’re widowed when your friends are still partnered.

If your spouse has died, attending therapy or joining a support group to share with others who have gone through the same thing can be very helpful, Jackson says.

After a widow or widower has worked through the acute stage of grief, she suggests they volunteer or become involved in an organization or activity that interests them. “Stay connected with people who have a similar loss, and when you are ready, do what you feel is important to you.”

Widowed older adults who are ready to start dating should also ask someone they trust about current dating norms and how to stay safe while dating, Jordan says.

Keep connected

No matter the circumstances behind your disappointment, envy, or regret, counseling helps to work through them.

A therapist can talk through how to deal with caregiving responsibilities, financial pressures, the loss of a spouse, or other issues.

While counseling costs can be a challenge if you’re on a limited budget, Medicare covers therapy (although not all therapists accept Medicare), and low-cost and free options are also available. Local departments of aging, senior centers, and chapters of the National Alliance on Mental Illness may offer resources.

Don’t be afraid to make that first call, Jackson says. “Therapy is really about drawing on strength and abilities,” Jackson says. “It’s a collaborative process to uncover them.” A therapist isn’t there to tell you what to do. Instead, they will help you find your own path — your own story to share.