Claire Zulkey lives in Evanston. Her health stories have also appeared in Chicago Health, the New York Times, the Atlantic and Runner’s World.

A money manager can provide oversight and add value

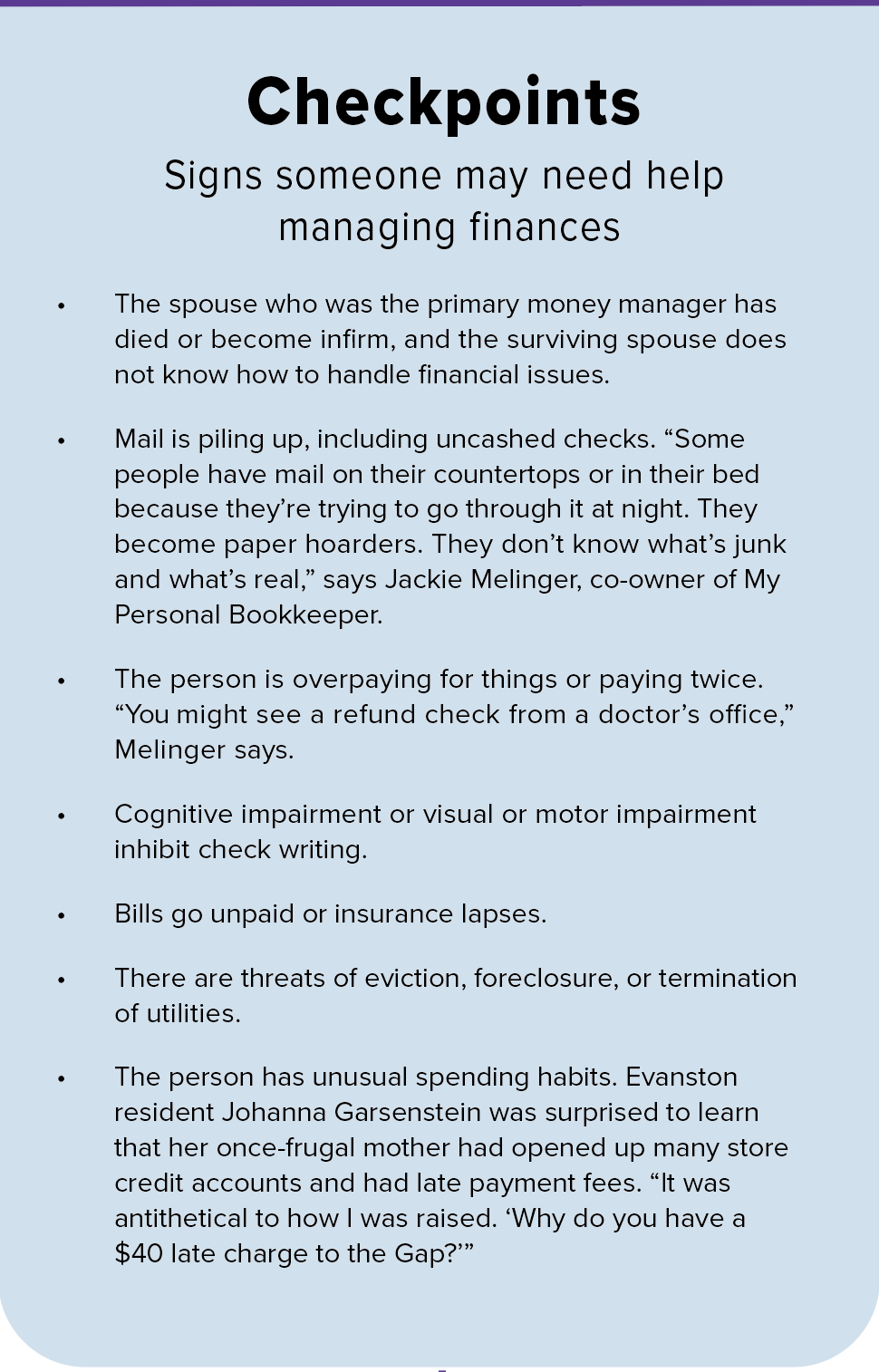

When Johanna Garsenstein visited her aging mother in Evanston, she was alarmed to see a large pile of envelopes asking for charity donations. “I knew something weird was going on,” she says. “As she got older and sicker, if anyone would ask her, she’d start opening her wallet.”

It was a sign that her mother (who passed away in 2008 at age 74) needed assistance managing her bills. Thanks to their close relationship and the aid of a financial trust, her mother let Garsenstein take over handling her accounts with the help of a professional money manager.

Older adults lose more than $3 billion annually to financial scams, according to the FBI. Still, fraud isn’t the only way elderly or cognitively impaired people can incur financial loss. When they become less able to manage finances, folks may overdonate, lose the ability to write checks due to eyesight issues or arthritis, become overwhelmed by piles of mail, or lose a relationship with a longstanding financial adviser.

“We once got involved with a woman putting piles and piles of paper in drawers,” says Jackie Melinger, co-owner of My Personal Bookkeeper. The Skokie-based firm provides personal household and daily money management. “As the [money] manager started looking through it, they saw a lot of IRS notices and found she hadn’t filed a tax return in seven years, when her accountant retired.”

Firms like Melinger’s help aging clients sort through papers, file documents, pay bills, review donations, and reconcile credit card statements.

“We always find things on credit cards that people don’t realize they’re paying for. You think you’ve signed up for a one-time thing, and it’s a monthly subscription. You forget,” Melinger says, recalling one client who was paying for 19 streaming services, including two Netflix accounts. “That can happen easily when each one says, ‘free trial.’”

The value of money management

Of course, not every senior or caregiver can afford a private manager’s rates. The National Society of Accountants’ 2020-2021 survey reports that the average Illinois accountant charges about $150 per hour for eldercare accounting services.

Other money managers provide services on a volunteer basis. The Illinois Department on Aging’s Illinois Volunteer Money Management Program matches trained, vetted volunteers from caregiver resource centers such as the Kenneth Young Center in Elk Grove Village and Oak Park Township Senior Services with eligible low-income older persons, people with disabilities, and victims of financial exploitation.

Volunteers undergo a background check and interviews. Staff from the programs, which are insured, also monitor client accounts, reviewing them annually.

Clients typically have difficulty managing their household budgets, paying bills, and keeping track of bank records. Many also need help with creditors or medical forms.

Trust plays a major role when working with a money manager. Clients need to disclose a lot of personal information, such as details about their spending, says Sophia Gonzalez, who oversees the Illinois Volunteer Money Management Program at the Illinois Department on Aging. “It won’t help if [the client] is not telling the volunteers that they have spent the money. They have to agree to let the volunteer know and write down or keep receipts to be assisted.”

When clients are on a spending plan, they see where their money is going and often realize the need for help. “Once they see they can save some money and it’s a valuable service, they realize it’s something they need,” Gonzalez says.

Financial issues can be touchy. “It can be a scary thing to let someone into your financial world,” Melinger says. “We start slow. We reassure people that we’re going to come in and work for them. Everything is very transparent.”

If adult children or guardians are involved, Melinger’s team updates them after each visit. “We also say, ‘This isn’t permanent. We can come in a few times a year to check in.’”

Melinger says working with a money manager early on saves worry later. Plus, she adds, whether you’re the caregiver or the person who needs assistance, “You can take more time for yourself. You have so many viable professionals in your life. This is one more professional to make things easier on people.”