Catherine, a freelance writer and editor based in Chicago, has written about healthcare and higher education for more than two decades. With 90-plus awards in communications, she is well-versed in storytelling.

A guide to enrollment and supplemental coverage for health insurance after age 65

Fact checked by Derick Wilder

Part of the beauty of turning 65 is you get to enroll in Medicare — no more worrying about staying employed to get health insurance or paying high rates for private coverage.

However, figuring out Medicare leaves many feeling overwhelmed and unsure where to begin. Enlisting the help of a specialized professional can make all the difference.

“I am a firm believer that you need to talk to somebody who is a true expert in Medicare, and that’s all they do,” says Robin Dawson, an independent broker and licensed agent for Medicare Solutions Network. “They’re not handling property and casualty insurance or other financial products. Their sole focus is on guiding people through the complexities of Medicare.”

Those complexities include unique federal requirements and strict deadlines that need to be met to avoid monetary penalties. But that’s not all.

Enrollment and sign-up

The initial Medicare enrollment period typically begins three months before your 65th birthday and extends for three months afterward.

To sign up for Medicare, visit the official Medicare website or contact the Social Security Administration for assistance. You can also enroll in person at a local Social Security office. Enrolling within three months of your 65th birthday is essential to avoid potential late enrollment penalties.

“You need to talk to somebody who is a true expert in Medicare, and that’s all they do.”

Dawson emphasizes that while government resources like Medicare.gov and 1-800-MEDICARE are helpful starting points, they are often not enough to navigate the full spectrum of choices. “There is detailed information about the private insurance pieces available through these resources, but it is hard to compare and understand the differences in products to make a choice based on individual needs. This is where the assistance of an insurance professional is invaluable.,” she says.

Irma Toro-Elliott, a market growth manager for United Healthcare Medicare Plans, agrees. “Navigating Medicare can feel overwhelming,” she says. “That’s why it’s important to seek to educate yourself. But as agents, we’re here to bridge that gap and ensure that everyone understands their options as we educate them on how Medicare works.”

Supplemental coverage options

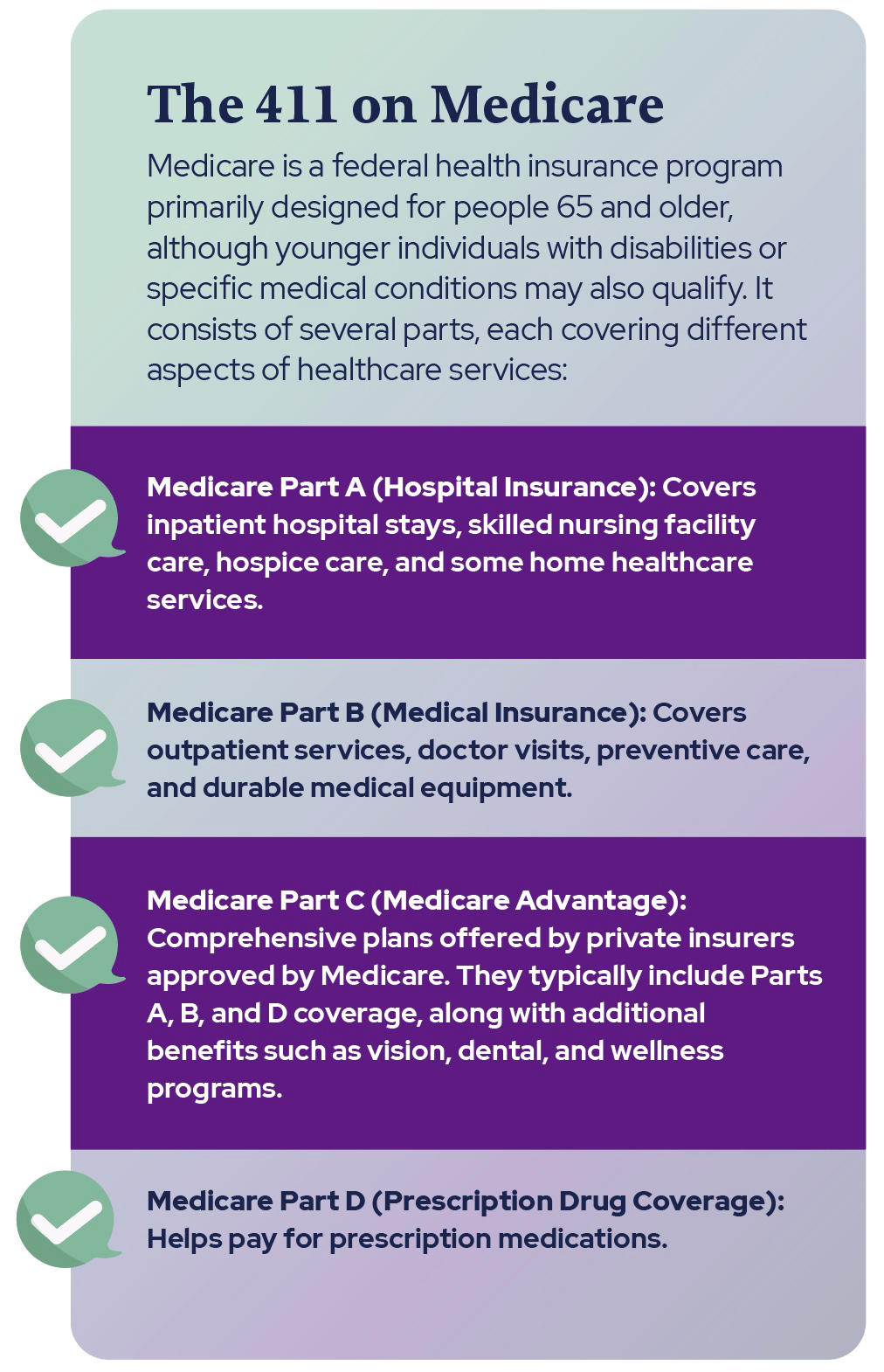

While traditional Medicare provides comprehensive coverage for many healthcare services, it has gaps. Supplemental plans, known as Medicare Supplement Insurance or Medigap policies, can help fill these gaps and provide additional benefits.

Medigap policies are private insurance policies, designed to cover out-of-pocket costs such as deductibles, coinsurance, and copayments associated with Medicare Parts A and B. These policies are standardized and labeled with letters (e.g., Plan A, Plan B), each offering different levels of coverage.

Medicare Advantage plans, on the other hand, are comprehensive health plans offered by private insurers that combine Parts A, B, and D coverage into a single plan. These plans may also offer vision, dental, and hearing coverage, as well as wellness programs, which traditional Medicare and Medigap policies don’t typically include.

Conquering confusion

Medicare’s complexity stems from the numerous options available, as well as the rules and regulations around enrollment and coverage. Fortunately, there are resources available to help people through the Medicare maze.

The official Medicare website offers a wealth of information, including educational materials, plan comparison tools, and enrollment guidance. Additionally, Medicare counselors and state senior health insurance programs (SHIPs) provide free, unbiased assistance to individuals seeking advice on Medicare-related issues.

Local organizations — libraries and community centers, for example — offer year-round educational workshops and seminars on Medicare topics. And in the digital realm, videos and tutorials are valuable resources for understanding Medicare basics and the enrollment processes. Some companies, such as United Healthcare, offer resources through their websites.

Local organizations — libraries and community centers, for example — offer year-round educational workshops and seminars on Medicare topics. And in the digital realm, videos and tutorials are valuable resources for understanding Medicare basics and the enrollment processes. Some companies, such as United Healthcare, offer resources through their websites.

“Medicare isn’t one-size-fits-all,” Toro-Elliott says. “Whether it’s Medicare Advantage or a Medicare supplement, understanding the differences is crucial in making informed decisions about your healthcare coverage. As a caregiver, I urge all caregivers to get involved in the Medicare process for their loved ones to assist in making the best possible decision that benefits them.”