An award-winning journalist, Katie has written for Chicago Health since 2016 and currently serves as Editor-in-Chief.

Women now make up a larger portion of unhoused Americans — and their role as caregivers plays a part in that risk

This is part 2 in a 4-part series on older adults and homelessness. Read part 1 about the current state of unhoused older adults in the U.S. here. Part 3 explores how street medicine meets older adults where they are.

For Jill (name changed for privacy), homelessness happened quickly. She and her husband had owned a small wallpapering business in the Boston area. But they moved in with Jill’s mother, who had dementia, so Jill could care for her.

Over time, Jill’s husband was diagnosed with cancer. Jill cared for him as well — two hospital beds now in their home — until both her mom and husband passed away. They died within three weeks of each other.

And three weeks after that, Jill’s cat died.

Jill eventually lost their home and ended up at a homeless shelter for the first time in her life. She shared her story with Judith Gonyea, PhD, professor at the Boston University School of Social Work. Gonyea has worked for decades towards helping people achieve “secure old age” — adequate retirement income, quality healthcare, and affordable housing.

Unhoused women today make up 38% of the homeless population, up from 5% in 1980. The population overall is growing older, too. In 1990, for example, the average age of the homeless adult population was 35. Today, it’s 50.

Women’s homelessness is often more complicated than the loss of a physical home. “A lot of the women’s stories speak to this caregiving role. The loss of a caregiving relationship — this social connection and bond — becomes the unraveling of their lives,” Gonyea says.

Gonyea remembers another woman, Virginia, whose housing unraveled after the loss of a loved one and their family home. When Virginia’s mother needed caregiving towards the end of her life, Virginia, the only one of her siblings without a spouse, readily volunteered. The work created a safe haven for Virginia. But after her mother’s death, she found herself without employment and stuck in a relationship with an abusive boyfriend who had drug addiction issues. He later died of an overdose, and Virginia finally felt free to go to a shelter.

The women’s stories stick with Gonyea, who has spent decades studying and working with unhoused women in their 50s. They’re a uniquely stigmatized group, she says. “We think of women as the ones who maintain the home and who are the nurturers. So when we see women not maintaining this ideal, they’re stigmatized, marginalized, seen as deviant.”

What puts women at higher risk?

Gonyea says that while the big-picture causes of poverty tend to be the same for men and women, women find themselves in those circumstances more frequently. Both men and women, for example, work in retail and the service sector — low-paying jobs that don’t offer benefits. Women, however, more commonly have these jobs.

But that’s not the only risk. “We know, as you get older, that living alone can put you at greater risk, and we know more older women live alone than older men. We know that women are more likely to have more years out of the labor force particularly for caregiving, whether for a child, spouse, or older parent,” Gonyea says.

But even working doesn’t solve the issue. “Wage inequity is also great, and that again contributes to women facing greater poverty in old age,” Gonyea says.

Older women experience higher levels of poverty compared to older men. And women of color, LGBTQ+ women, and single women face the greatest economic challenges as they age.

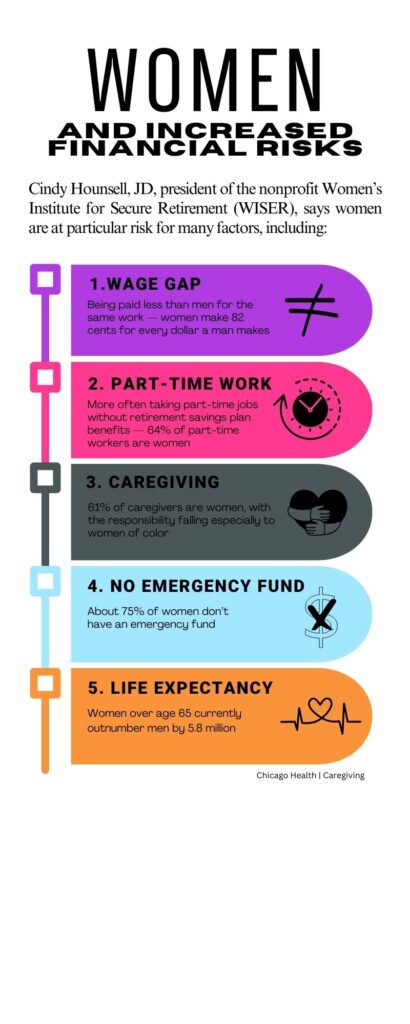

“A lot of women who have never been poor in their lives become poor,” says Cindy Hounsell, JD, president of the nonprofit Women’s Institute for Secure Retirement (WISER).

Hounsell has dedicated her work to setting women on a course to protect their financial future. And Baby Boomers, the current generation at or near retirement, need the help. The U.S. Census Bureau reports that 2 in 5 Baby Boomers have no retirement savings.

Hounsell says one option women have is to stay in the workforce for longer. “That’s going to give you money. I don’t like it as a solution, and some people can’t do that.” However, she sees at least one added benefit: “A lot of times the women who keep working aren’t isolated.”

Yet, for people currently retiring at 65, Social Security predicts they will live 20 more years. And while Social Security pays the average retiree about $1,800 a month, the average household of someone over age 65 spends upwards of $4,300 monthly.

If Social Security ended tomorrow, 40% of people’s incomes would drop below the official poverty line. Right now it’s around 10%. “It’s an important program that lifts so many out of poverty, but it’s built around the traditional nuclear family. That’s not the reality for so many now. So what does that mean?” Gonyea says.

Caregiving offers a sense of self

In Gonyea’s work, she sees how women’s caregiving roles have put them at greater risk for financial detriment. But she also sees how that identity gives them purpose.

“It’s one of the ways many older women resist or reject this stigmatizing identity of being homeless,” she says. “Mothers, daughters, sisters, friends, paid caregivers — it’s a way they validate and create a sense of self.”

Jill told Gonyea that her role as Nana for her twin granddaughters brings her joy. She has never revealed to her stepdaughter that she is homeless. Yet, she sees her granddaughters several times a year.

One Christmas, Jill saved up for a visit, budgeting $200 for bus fare and presents. The day after Christmas, she took the girls shopping, giving each $25 to spend on whatever they wanted. Secretly, though, she reserved an extra $25, anticipating requests beyond their set budgets.

“It gives her a positive sense of self, contributing, a connection,” Gonyea says.

Another woman, who Gonyea calls Pam, is unhoused but still looks out diligently for her son, who has bipolar disorder. He doesn’t always take his medication, so she checks in and reminds him regularly. “He’ll always be my baby, so I have to keep an eye on him,” she told Gonyea.

And then there are the women who Gonyea says don’t have ongoing relationships with their families but who care for other women in the shelter.

“I think it’s so much an important thing to recognize the role of relationships,” Gonyea says. “Even though these women lack hearths, lack homes, they work hard to maintain these ties.”

When Hounsell moved to Washington, D.C. after attending law school in New York, she says she realized that so many older women were poor. “It’s always been like this. It really pissed me off,” she says. “I have a big smile on my face, but I’m still pissed off.”

Given women’s extra risks, she encourages them to prepare for the future. “I started late. I bought my house when I was 54,” Hounsell says, adding that it’s never too late to start saving whatever you can. “Just have a goal, even if it’s an emergency fund so when you have a flat tire you can pay for it.”

Hounsell is hopeful that women can improve their situations with the right information and guidance. “People can make such changes in their lives if you give them information that is useful to them. I hate what happens to women, but a lot of times, women just don’t pay attention, or they give it all away to somebody else, like the grandchildren.”

This increase in unhoused women in the U.S. happens at the intersection of ageism, sexism, and racism. One Chicago woman, Rita, lives at that intersection. Her bright orange tent sits under a giant tree just beyond the lakefront.

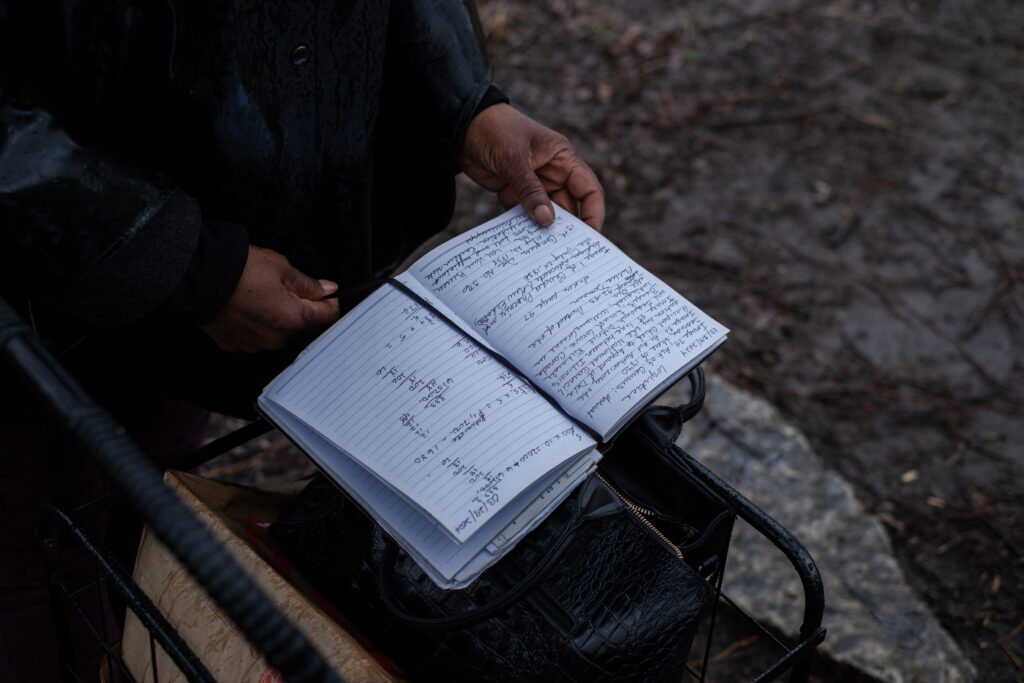

For years, Rita ran a daycare out of her home in the suburbs. She says she worked with government to start a lead remediation project at a local playground. “I care about children, and I made sure that every park and playground was suitable and free of lead contamination. I worked on that with some very good people.”

Rita says she never thought she would be living in a tent near the lake, her clothes hanging neatly from a line under the tree. But she says she was forced from her home. Now, she considers this her home. “I settled here freely on my own.”

So much of the U.S. housing crisis reflects decades-old structural racism in our society: redlining, panic peddling, and denial of mortgages. Understanding the roots of the issue can help society move beyond it.

“One of the biggest sources of wealth that many families have is their home, and the structural discrimination in housing prevented that intergenerational transfer of wealth for many families of color. That has deepened my commitment to lifting up this issue,” Gonyea says.

Rita, meanwhile, is committed to accessing her Social Security payments when the time comes in 2025. “I paid into it for years,” she says. “And if I get my pension in 2025 — because I have proof that I paid into it — next time you come, I’ll be in a log cabin.”

This series is published as a partnership between Caregiving Magazine and Chicago Health Magazine. It was written with the support of a journalism fellowship from The Gerontological Society of America, The Journalists Network on Generations, and The John A. Hartford Foundation.

Series illustration by Dan Leu.