Catherine, a freelance writer and editor based in Chicago, has written about healthcare and higher education for more than two decades. With 90-plus awards in communications, she is well-versed in storytelling.

What private equity ownership means for healthcare access and pharmacy services

![]() Fact checked by Ros Lederman

Fact checked by Ros Lederman

In a landmark shift for the retail pharmacy industry, New York-based private equity firm Sycamore Partners will finalize a purchase of Walgreens Boots Alliance for $10 billion later this year, with potential to pay as much as $23.7 billion once other costs are factored in. The deal takes Walgreens private, ending its nearly century-long run as a publicly traded company.

The sale follows years of operational struggles, including declining prescription reimbursement rates and a consumer spending switch to Amazon and big-box stores such as Costco. Since taking over as CEO in 2023, Tim Wentworth has led an aggressive turnaround strategy, which includes closing 1,200 underperforming stores over the next three years in hopes of improving financial performance.

“Throughout our history, Walgreens Boots Alliance has played a critical role in the retail healthcare ecosystem,” Wentworth said in a March 6 statement. “We are focused on making healthcare delivery more effective, convenient, and affordable as we navigate the challenges of a rapidly evolving pharmacy industry and an increasingly complex and competitive retail landscape.”

Wentworth added that going private will enable a more strategic overhaul of the Deerfield, Illinois-based Walgreens.

The sale signals a major shift in the company’s future direction, particularly its primary care strategy. Although Walgreens once committed to expanding VillageMD, a clinical care company with clinics inside some 600 Walgreens stores, the company has struggled to find success in the space, according to the American Hospital Association. Last year, the company announced the closure of 160 clinics and has since attempted to sell VillageMD, which includes Village Medical, Summit Health, and CityMD.

At the same time, significant downsizing may be on the horizon as Walgreens faces billions in debt and opioid-related liabilities.

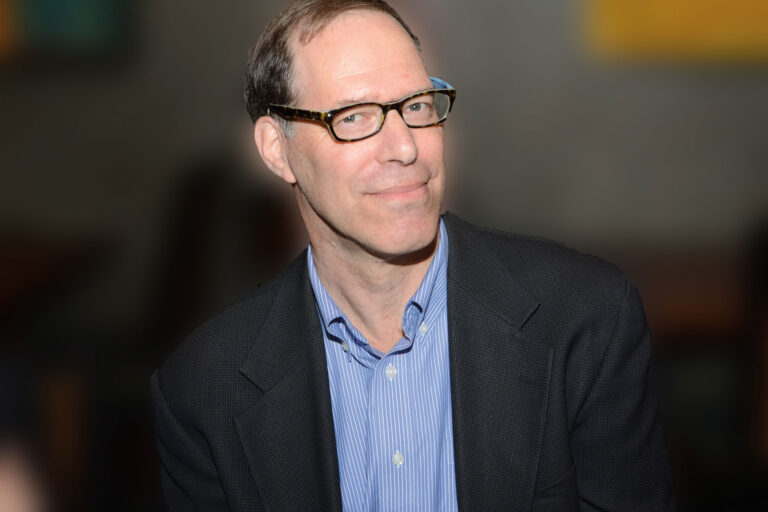

“It is certainly a concern that a change in ownership could lead to changes in priorities, including less emphasis on underserved communities,” says Constantine Yannelis, PhD, professor of financial economics at the University of Cambridge and formerly of the University of Chicago. “It is hard to know, though, what will happen without deep insight into the new management team’s plans.”

Walgreens has become a key provider of vaccinations and other primary care services, with more than 50% of Walgreens stores located in underserved communities. In Chicago along, Walgreens has more than 100 stores (and 8,500 in the U.S. and Puerto Rico).

Health disparities in Chicago could widen if the pharmacy reduces its footprint in vulnerable communities. And the potential for city government intervention may be limited. “It is hard for [Chicago] to do much, especially given the city’s dire financial situation,” Yannelis says. “A city can’t force a business to operate, so the only possible thing to do is to provide financial incentives, but this is quite costly.”

The proposed sale has raised concerns about drug prices, pharmacy access, and healthcare services in Chicago and elsewhere. Yannelis warns that private equity ownership could impact costs and availability.

“The sale of Walgreens could lead to significant concerns about both pricing and access. Past research has shown that following private equity acquisitions, prices rise slightly,” Yannelis says, citing a 2022 study.

It’s also unclear how this will affect independent pharmacies. “If Walgreens locations close, this could benefit smaller independent pharmacies,” he says.

And those pharmacies say they’re ready. In 2023, as CVS, Walgreens, and Rite Aid announced store closures, the National Community Pharmacists Association surveyed 10,000 independent pharmacy owners. The majority of respondents (90%) located near a major pharmacy chain store said they had capacity to absorb patients. Many were increasing their advertising and marketing campaigns to attract the impacted customers.

“Chain pharmacies in the United States are closing left and right, leaving Americans on both sides of the aisle looking for new pharmacies and independent pharmacies often scrambling to rescue them,” Association CEO B. Douglas Hoey said in a press release at the time of the survey. “It’s unclear if this is an opportunity or threat for independent pharmacies. But one thing is certain: patient access to community pharmacies is in peril without reforms to PBMs [pharmacy benefit managers] and the pharmacy payment model.”

Regardless of whether this signals the start of a broader trend, Yannelis says oversight is needed. “It is important that there is monitoring and regulation, as well as transparent quality disclosure and competition.”

The coming months should reveal whether Walgreens’ privatization leads to efficiencies or further challenges in healthcare access and affordability.