Jennifer is an award-winning writer and bestselling author. She is currently dreaming of an around-the-world trip with her Boston terrier.

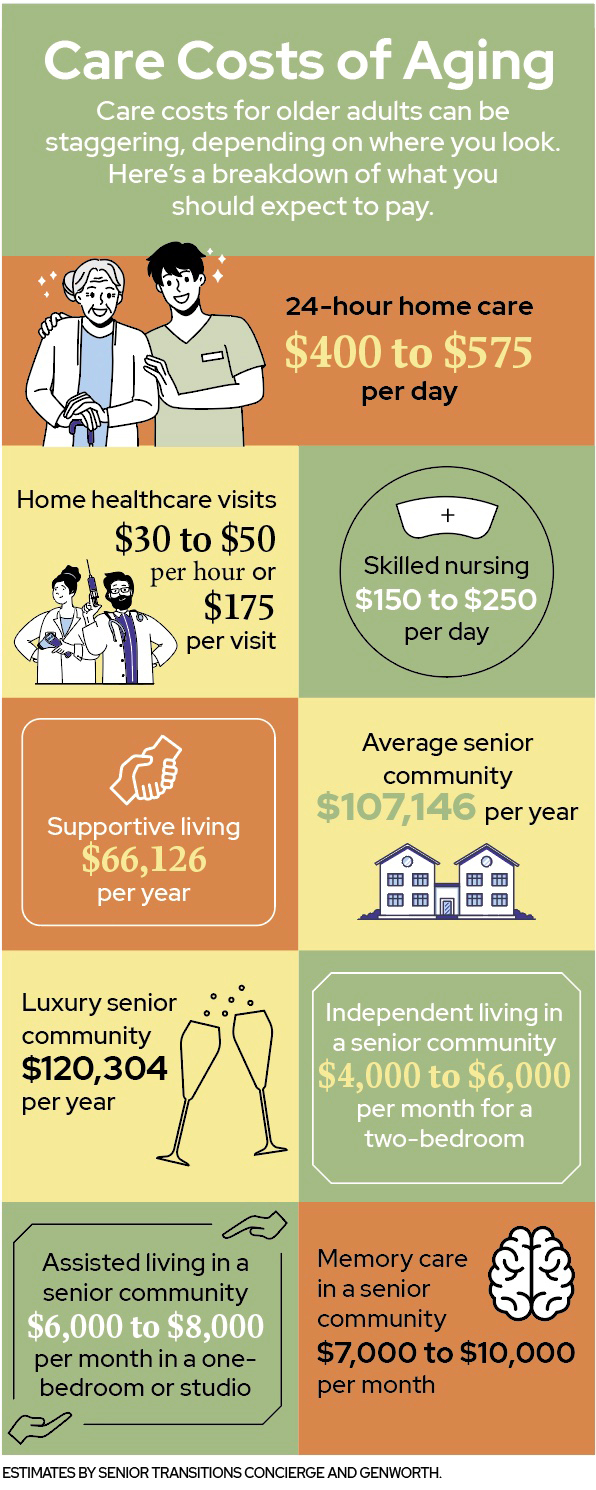

Aging isn’t cheap — costs to keep in mind throughout the years

Fact checked by Derick Wilder

How much money do you need in order to retire? There’s a number for that — but it may differ depending on who you ask.

Ideally, you will have saved about 10 times your annual income by age 64 to be prepared for retirement, according to Bank of America’s Financial Wellness Tracker.

That’s only one part of the equation, though. Imagine you live to age 100. That’s about 35 years of income needed post-retirement. And it doesn’t necessarily include the cost of retirement homes, healthcare as you age, or caregiver costs, which can be substantial.

If you haven’t started saving for aging yet, there’s no better time than the present.

Jan Steiner, founder of Senior Transitions Concierge, a business that helps families find communities as they age, says that even just knowing what to expect is a good start so you can begin to save — or at least figure out where the money is going to come from.

“People need to look into it to have a feel for what to expect, even in their 50s,” she says. “Just knowing the amounts and trying to manage what you have or making some sort of a plan is helpful.”

Ideally, you’ll have been saving for retirement since your very first job. But if that isn’t the case, try to wrap your head around what you’ll need now.

And prepare for some sticker shock.